Homeowners Insurance in and around Hamburg

Looking for homeowners insurance in Hamburg?

Help cover your home

Would you like to create a personalized homeowners quote?

What's More Important Than A Secure Home?

One of the most important steps you can take for your favorite people is to cover your home through State Farm. This way you can take it easy knowing that your home is covered.

Looking for homeowners insurance in Hamburg?

Help cover your home

Why Homeowners In Hamburg Choose State Farm

From your home to your precious keepsakes, State Farm has insurance coverage that will keep your valuables secure. Shawn O'Rourke would love to help you feel right at home with your coverage options.

Whether you're prepared for it or not, the unanticipated can happen. But with State Farm, you're always prepared, so you can kick off your shoes knowing that your belongings are insured. Additionally, if you also insure your vehicle, you could bundle and save! Contact agent Shawn O'Rourke today to go over your options.

Have More Questions About Homeowners Insurance?

Call Shawn at (716) 649-6900 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to use your hand tools more safely

How to use your hand tools more safely

Simple safety tips to help you choose and use your hand tools before you start your next DIY project and how to maintain them and protect yourself and others.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

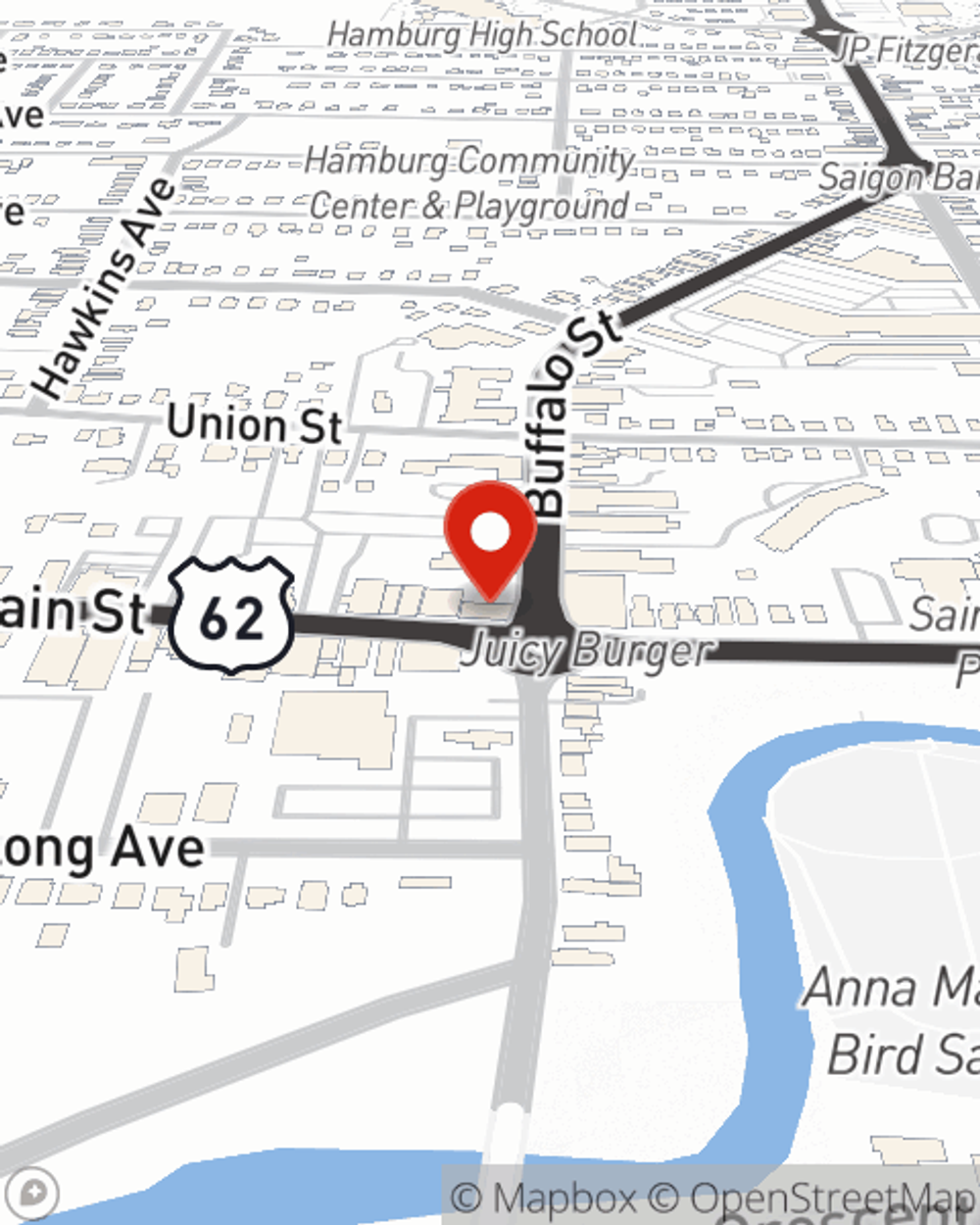

Shawn O'Rourke

State Farm® Insurance AgentSimple Insights®

How to use your hand tools more safely

How to use your hand tools more safely

Simple safety tips to help you choose and use your hand tools before you start your next DIY project and how to maintain them and protect yourself and others.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.